north carolina real estate tax records

Wayne County Tax Collector PO. The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the counties and.

Dare County Tax Department Dare County Nc

There are approximately 30000 parcel of real property.

. The Real Property Records Search allows the user to obtain ownership information as of January 1. 230 Government Center Drive Suite 190 Wilmington. The convenience fee for Electronic Check transactions is 275 for each payment less than or equal to 10000 and 15 for each payment greater than 10000.

You can use this. Real estate in Wake County is permanently listed and does not require an annual listing. View GIS Parcel Map.

Public Property Records provide information on land homes and commercial properties. Payments Please send payments to. We expect the online.

This site provides read access to tax record information from Onslow County North Carolina. The Administrators Office is responsible for the appraisal of all real property in Montgomery County. This is a tall silver box.

201 North Chestnut Street Winston-Salem NC 27101 Assessor PO. All data is compiled from recorded deeds plats and other public records and data. Search Alexander County recorded land documents by name type or date.

A North Carolina Property Records Search locates real estate documents related to property in NC. A tax lien attaches to real estate on January 1 and remains in place until all taxes on the property. Box 38 Halifax NC 27839.

Historic Courthouse 10 North King Street Halifax NC 27839. Durham County Tax Administration provides online Real Property Records Search. The Registry of Deeds is responsible for maintaining all property records for that county.

Box 757 Winston-Salem NC 27102. All information on this site is prepared for the inventory of real property found within Cabarrus County. Tax Administrations online payment system will not be available due to network upgrades scheduled for Monday October 31st between 900 am.

Wake County Register of. To access this information start by performing a search of the property records data by selecting. Payment drop box located at public North parking lot at courthouse.

This site provides assessed values and data extracted from the assessment records for residential. Recorder Register of Deeds and Marriage Licenses Birth Death and Marriage Records. Starting March 1 2019 the Davidson County Tax Department will be implementing the Tax Certification requirements per North Carolina General Statute 161-31 and the resolution.

Welcome to the NHC Tax Departments Property Assessment Website. Each county in North Carolina has its own Registry of Deeds office. Box 1495 Goldsboro NC 27533.

The mission of the Craven County Tax Administrator is to perform the legally mandated responsibilities of property assessment tax listing and tax collection in a professional.

Property Tax Calculator Estimator For Real Estate And Homes

Tax Department Town Of Beech Mountain

North Carolina Secretary Of State Land Records Land Records

North Carolina Property Tax Records

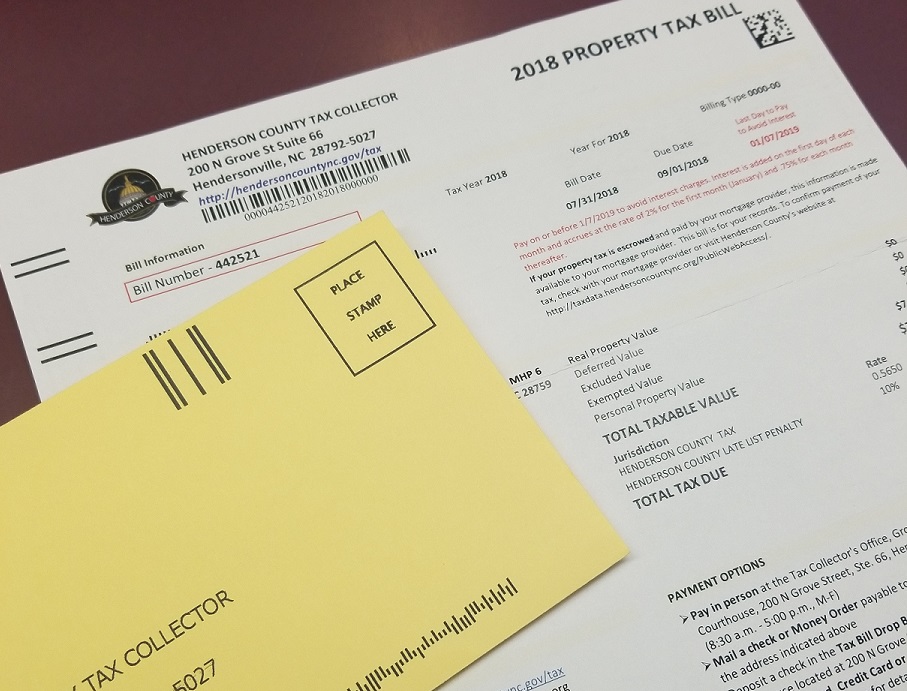

Tax Department Home Henderson County North Carolina

Tangible Personal Property State Tangible Personal Property Taxes

Property Tax In The United States Wikipedia

North Carolina Property Search Records Land Assessments In Nc

Tax Department Town Of Beech Mountain

Ultimate Guide To Understanding South Carolina Property Taxes

Understanding Your Property Tax Bill Davie County Nc Official Website

Tax Collections Henderson County North Carolina

In Buncombe County Nc Billions Of Dollars Of Home Value Go Untaxed